Specialists in art fractional ownership

Become a part of the art world by collecting carefully curated, high-value artworks from renowned artists like Marc Chagall. Our platform makes it easy to start or expand your art collection.

Create

your free account

Browse

exclusive artworks

Select

shares to purchase

Access your

digital portfolio

Most Recent Projects

We have successfully sold four masterpieces with fractional ownership, including a stunning embroidered artwork by Alighiero Boetti and a unique gouache by Marc Chagall.

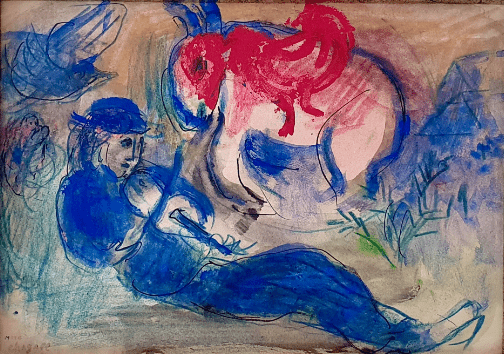

UNTITLED

Marc Chagall

Marc Chagall is a Blue-Chip artist and his work has always played a primary role in the art market. His artworks can also be found in renowned collections all over the world, such as the Montreal Museum of Fine Arts, the Solomon R Guggenheim Museum, New York, and the Art Institute of Chicago. According to Sotheby's Mei Moses index, the average compound annual return for a Chagall resold at auction between 2003 and 2017 was 6.8%, and 85% of 294 such works increased in value, especially over the last 20 years, during which he has always ranked amongst the top 40 artists in the world in the Artprice Top List (in 2021, he was n. 27). In fact, there has been a boom in Chagall's market since 2000. He has very much become a global figure with an international market. His record is $28.4 million for the artwork 'Les Amoureux' (1928), achieved at a Sotheby's auction in November 2017, in New York. According to Artprice, £100 invested in a work by Marc Chagall in 2000 would be worth an average of £261 (+ 161%) in December 2021.

Why Collect Art?

Art is often defined as a safe haven asset: it is a value preserving asset-class, especially in times of economic and financial turmoil. Like gold, artworks are less susceptible to risks associated with financial market crashes than stocks and bonds. Because of its intrinsic value as a luxury item, art is able to rebound and even grow faster than traditional asset classes in response to economic crises.

This dynamic has been highlighted by the 2008 financial crash. While the Artnet index for the Top 100 Artists bounced back and even outperformed its 2008 peak within two years of the drop, the S&P 500 took five years to recover, only regaining its strength by 2013. These data demonstrate the capability of artworks by Blue-chip artists, such as Boetti or Chagall, whose positions within the market have been consolidated by exceptional sales volumes over the course of several years, retaining their value during economic downturns. Between 2019 and 2021, the Artnet Index for the Top 100 Artists displayed a considerable positive return over time, consistently outpacing the S&P 500 in growth, proving the strength of the market at a general time (Deloitte Art&Finance, 2021).

How do we select our artwork?

Our Art Department Team continuously analyzes the art market, with the aim to identify the most suitable artists for a fractional art project among the Blue-Chip target. More specifically, our aim is to identify artworks that can be classified as safe-haven assets for their capability to retain their value in the long term, looking at the past performances of the artists work and at comparable pieces. After that, we start an accurate search of the most suitable pieces, thanks to our valuable and extensive network of international contacts in the art world. Once a suitable piece has been found, we proceed to the negotiation in order to purchase the piece or to settle an agreement with the owner to sell the work in Art Shares on our platform.

Our Commitment

We are committed to adding value to the artworks we offer by circulating them within the wider art market. Our mission is to make art more accessible to a larger audience through the organisation of regular exhibitions and our rental programme dedicated to museums and other art institutions. The aim of this is to further support the fruition of artworks that may otherwise be hidden away in vaults. We also offer our co-owners the opportunity to temporarily hold the pieces they co-own.

Why LTArt?

Our female-led team is comprised of experienced art and finance specialists, who believe in the value of combining art and tech to not only innovate but also democratise the art market. We are passionate about art and want to share that passion, meaning that when you become a co-owner, you also become part of our LTArt community, where you will be able to attend exclusive events related to the artwork(s) you co-own.

Our core belief is that everyone should have the opportunity to start building an art collection based on sophisticated market data, regardless of budget. Moreover, our strong partnerships with the international law firm Withersworldwide, which has developed the regulatory framework for our fractional ownership projects, and 1fs Wealth, which is at the forefront of wealthtech, are what make us leaders in the field. Our online platform also enables 24/7 access to your shares and digital certificates affirming authenticity and joint ownership.

Latest Articles

LTArt Magazine

The 2025 Deloitte Art and Finance Report reveals the growing strength of the mid-tier market and the rise of fractional ownership in reshaping global art investment.

As the global art calendar becomes increasingly packed, collectors and galleries face a new challenge: when every event seems crucial, how do you decide what to attend—and what to skip?

As the art market cools, institutional validation may prove the most reliable engine for discovering and sustaining tomorrow’s masters.

Bear with us

We're working on new share opportunities

Sign up to our newsletter to be the first to hear about what's coming next!