The Rise of the Mid Tier: Art’s New Centre of Gravity

As global wealth strategies evolve, the art market finds itself at a pivotal moment. The 2025 Deloitte Art and Finance Report reveals an ecosystem increasingly shaped by new generations of collectors, technology-driven transparency and a recalibration of value away from speculation toward purpose and sustainability. Amid this transformation, the mid-tier segment, comprising works priced between US$50,000 and US$1 million, is emerging as the market’s most dynamic frontier.

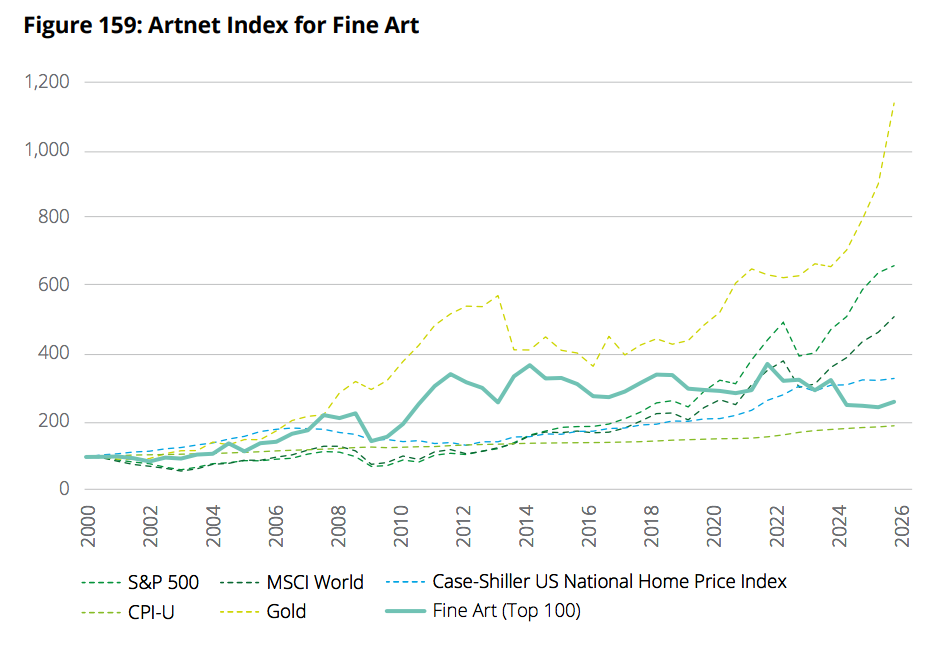

Deloitte & ArtTactic, Art & Finance Report 2025; Artnet Price Database

A resilient and expanding segment

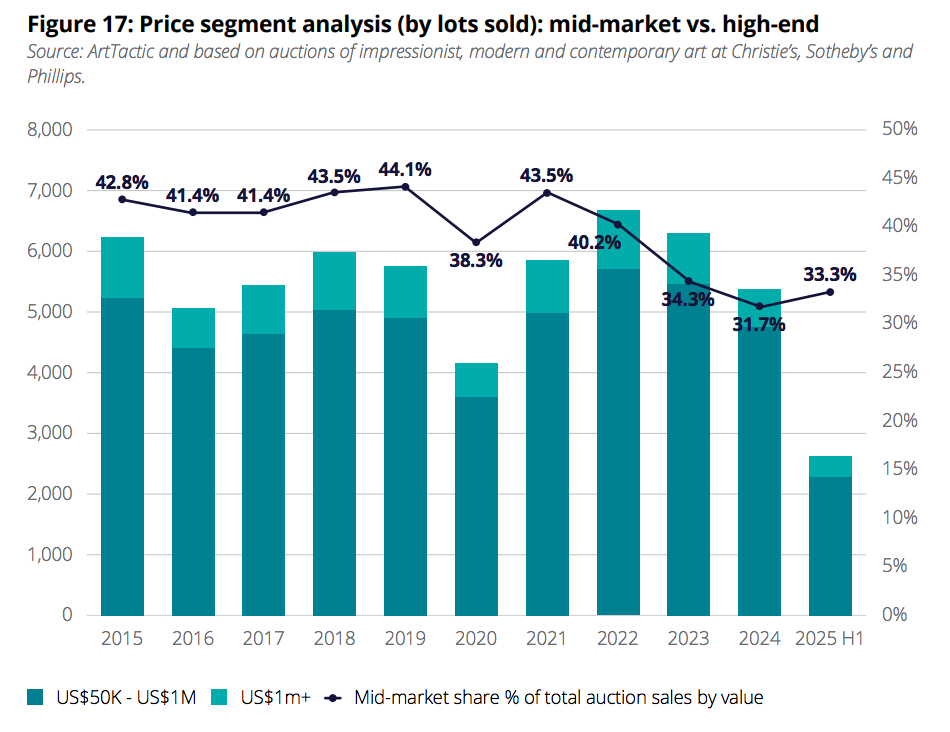

While the top end of the market has faced volatility and reduced trophy piece activity, the mid-tier has shown remarkable resilience. In 2024, this segment accounted for US$8 billion in global auction sales, representing nearly one-third of all lots sold. According to Deloitte, mid-tier artworks have proven less vulnerable to downturns and more appealing to new and younger buyers seeking quality, access and long-term potential rather than speculative short-term gains.

This layer of the market also provides an essential bridge between collecting and investing. It is where taste formation, education and financial strategy intersect, offering fertile ground for both cultural engagement and wealth diversification.

Broadening participation and legacy

The report underlines that nearly 80% of wealth managers, collectors and art professionals now believe art belongs in a wealth management offering. Yet fewer wealth managers are directly providing such services, now at 51% in 2025, due to regulatory and operational complexity. This opens the door for independent platforms and third-party providers specialising in mid-market opportunities, particularly those capable of combining expertise, liquidity and compliance.

The mid-tier’s growth is also being driven by the next generation of collectors, whose motivations are shifting. For them, art ownership is as much about identity, purpose and cultural legacy as it is about financial performance. Deloitte’s data shows that 72% of next generation collectors value legacy and impact over pure returns, signalling a more holistic and human-centred approach to collecting.

Deloitte & ArtTactic, Art & Finance Report 2025, based on ArtTactic data

Fractional ownership and democratising access

Alongside this generational shift, fractional ownership models continue to redefine the way collectors and investors engage with art. Both traditional co-investment structures and blockchain-enabled tokenisation initiatives are gaining ground. Although still a small slice of the overall market, Deloitte identifies fractional ownership as one of the clearest indicators of art’s movement into diversified wealth portfolios.

For younger collectors, owning a fraction of an artwork is less about control and more about participating in a cultural narrative. Platforms facilitating these shared ownership models have demonstrated growing demand, particularly in the mid-tier range where the price points align with scalable investor pools.

These models also serve a practical function by enhancing liquidity and broadening access without compromising the emotional value of collecting. Deloitte forecasts that co-ownership frameworks will become an increasingly recognised asset class within wealth management by 2030.

From asset to ecosystem

The mid-tier and fractionalisation trends converge in a broader transformation that positions art as a connected ecosystem rather than an isolated asset. Family offices, wealth managers and next generation investors are looking for integrated solutions that combine collection management, philanthropy, estate planning and social impact.

Art’s role is expanding beyond diversification. It now reflects how wealth is expressed, transferred and experienced. The report projects that art and collectable wealth among UHNWI will reach US$3.47 trillion by 2030, with nearly US$1 trillion expected to change hands in the coming decade as part of the Great Wealth Transfer. This underscores the urgency of building structures that can both preserve and democratise value.

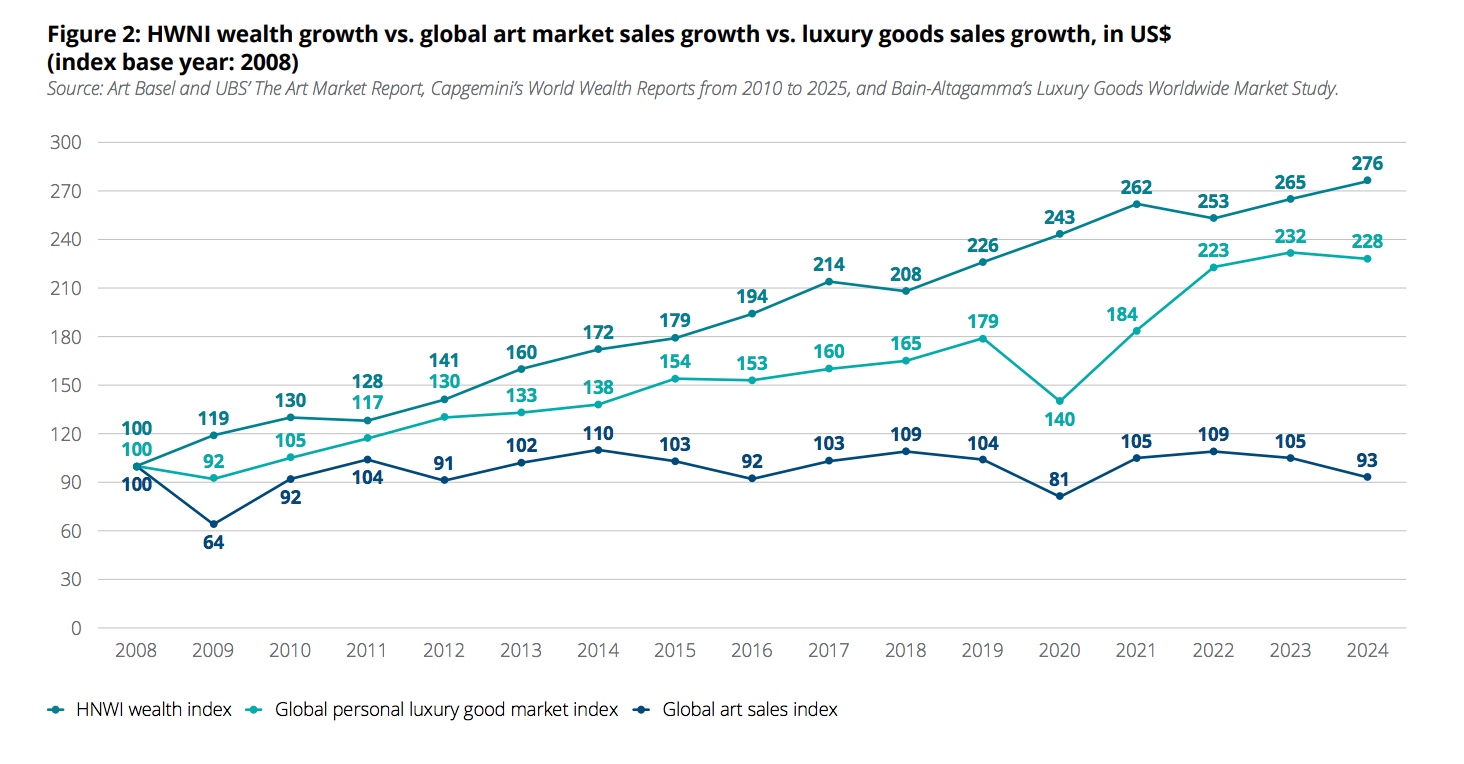

Deloitte & ArtTactic, Art & Finance Report 2025, based on Art Basel & UBS The Art Market Report, Capgemini World Wealth Reports 2010–2025, and Bain-Altagamma Luxury Goods Worldwide Market Study

Looking ahead

For the art market to thrive sustainably, the mid-tier must be recognised not as a secondary segment but as its stabilising core. Here, innovation in financing, transparency and fractional ownership can transform how collectors connect with art in financial, cultural and emotional terms.

As Deloitte notes, recognising and developing art wealth services for this mid-market tier represents an opportunity to expand the market, attract new audiences and direct more wealth toward a wider range of artists. In this space, the future of art and finance looks not only inclusive but resilient.

Source:

Deloitte & ArtTactic, Art & Finance Report 2025;

Reuters “Art Basel Shows More Mid-Priced Art to a Sombre Market,” June 2025